Things about Kam Financial & Realty, Inc.

Table of ContentsOur Kam Financial & Realty, Inc. IdeasSome Known Questions About Kam Financial & Realty, Inc..The Single Strategy To Use For Kam Financial & Realty, Inc.Kam Financial & Realty, Inc. for DummiesA Biased View of Kam Financial & Realty, Inc.The Of Kam Financial & Realty, Inc.What Does Kam Financial & Realty, Inc. Mean?Not known Details About Kam Financial & Realty, Inc.

If your neighborhood county tax obligation price is 1%, you'll be billed a building tax obligation of $1,400 per yearor a regular monthly home tax obligation of $116. We're on the last leg of PITI: insurance coverage. That's not necessarily a bad point.What a relief! Bear in mind that wonderful, elegant escrow account you had with your building tax obligations? Well, guess what? It's back. Just like your property taxes, you'll pay part of your homeowner's insurance premium in addition to your principal and interest settlement. Your lender gathers those repayments in an account, and at the end of the year, your insurance policy company will certainly draw all that cash when your insurance payment schedules.

Things about Kam Financial & Realty, Inc.

It's indicated to shield the loan provider from youwell, a minimum of from the possibility that you can not, or just flat do not, make your mortgage repayments. Naturally, that would certainly never be youbut the loan provider does not care. If your down repayment is much less than 20% of the home's price, you're going to obtain penalized PMI.

If you belong to a community like one of these, don't ignore your HOA cost. Relying on the age and dimension of your home and the amenities, this might add anywhere from $50$350 to the quantity you pay monthly for your overall housing expenses. There are many kinds of home loans and they all bill various monthly repayment amounts.

The Ultimate Guide To Kam Financial & Realty, Inc.

Given that you wish to get a mortgage the clever means, connect with our good friends at Churchill Home loan - mortgage lenders california. They'll walk with you every step of the way to place you on the most effective course to homeownership

What Does Kam Financial & Realty, Inc. Mean?

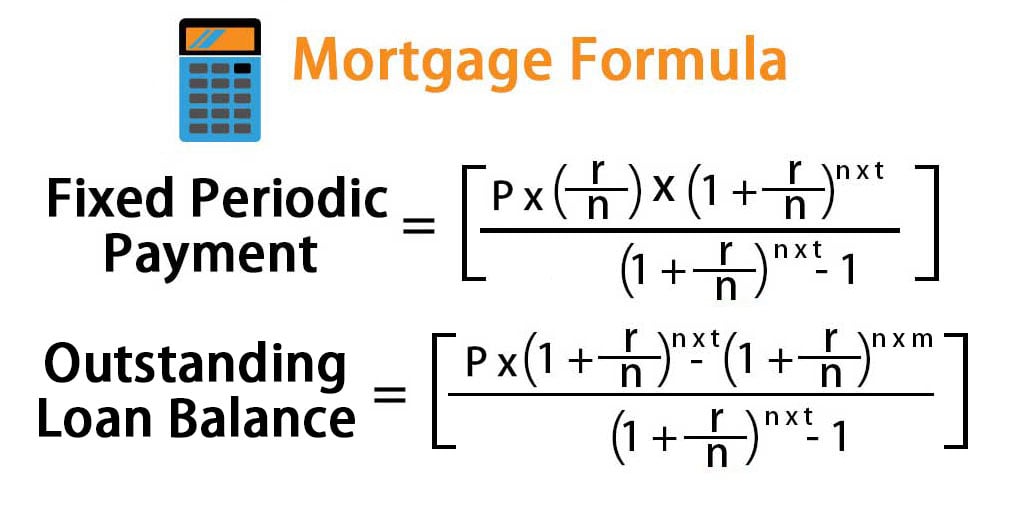

This is the most usual kind of mortgage. You can pick a term approximately 30 years with many loan providers. The majority of the very early repayments settle the passion, while the majority of the later payments pay off the principal (the preliminary amount you borrowed). You can take a table funding with a fixed interest rate or a drifting price. https://filesharingtalk.com/members/601054-kamfnnclr1ty.

Most lending institutions bill around $200 to $400. This is commonly negotiable. mortgage lenders california.: Table lendings supply why not try these out the technique of regular settlements and a collection day when they will certainly be repaid. They offer the assurance of recognizing what your settlements will be, unless you have a floating price, in which case repayment amounts can change

The smart Trick of Kam Financial & Realty, Inc. That Nobody is Talking About

Revolving credit report loans work like a gigantic over-limit. Your pay goes directly into the account and bills are paid of the account when they're due. By maintaining the lending as low as possible at any moment, you pay much less passion due to the fact that loan providers determine rate of interest daily. You can make lump-sum payments and redraw cash up to your limitation.

Application fees on revolving credit rating mortgage can be as much as $500. There can be a charge for the daily banking purchases you do via the account.: If you're well ordered, you can pay off your home mortgage much faster. This additionally fits individuals with unequal earnings as there are no set repayments.

Some Of Kam Financial & Realty, Inc.

Deduct the cost savings from the total financing amount, and you only pay passion on what's left. The even more cash you maintain throughout your accounts daily, the extra you'll save, due to the fact that rate of interest is determined daily. Linking as many accounts as possible whether from a companion, parents, or other member of the family means even much less passion to pay.

A Biased View of Kam Financial & Realty, Inc.

Repayments start high, but minimize (in a straight line) over time. Costs are comparable to table loans.: We pay less interest overall than with a table finance since very early repayments consist of a greater payment of principal. These might suit debtors that expect their income to go down, for example, if one companion plans to offer up job in a couple of years' time.

We pay the interest-only part of our settlements, not the principal, so the settlements are reduced. Some customers take an interest-only finance for a year or 2 and after that switch over to a table finance. The normal table car loan application costs apply.: We have more cash money for various other things, such as improvements.

What Does Kam Financial & Realty, Inc. Mean?

We will still owe the total that we borrowed until the interest-only period ends and we begin paying back the finance.

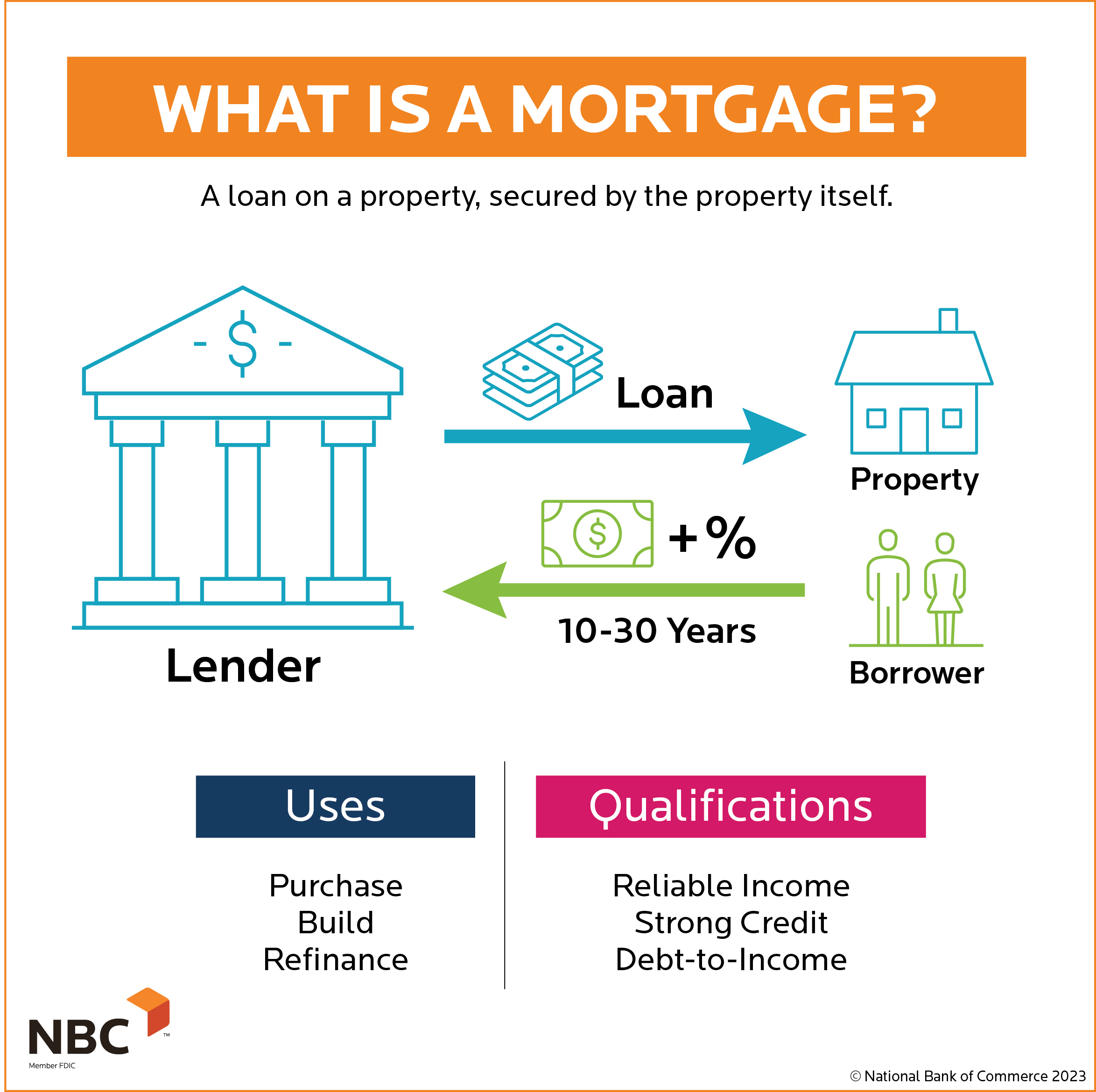

The home mortgage note is generally videotaped in the public documents along with the mortgage or the act of depend on and works as evidence of the lien on the building. The mortgage note and the home mortgage or deed of trust fund are two various documents, and they both offer various lawful objectives.